Other projects

Gold

Kodal also has a portfolio of highly prospective gold projects located strategically across southern Mali and Côte d’Ivoire, which are undergoing early-stage exploration programmes with a view to developing significant JORC compliant gold inventory.

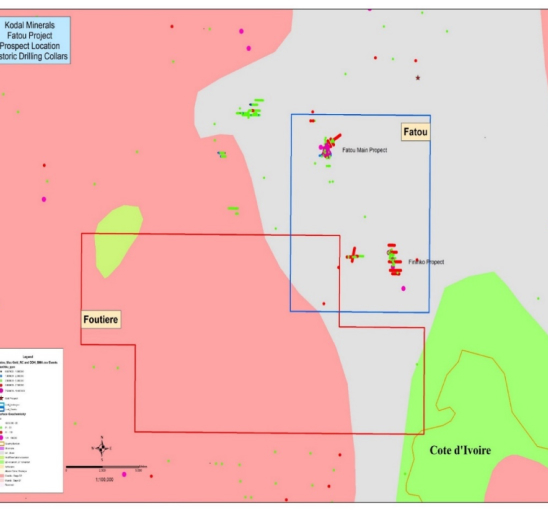

Fatou Gold Project, Mali

Kodal Minerals negotiated the rights to explore and an option to purchase up to 100% of Fininko and Foutiere concessions in December 2020, together known as the Fatou Project which totals 301Km2 and is located 280km south of Bamako, Mali’s capital.

Fatou Project is located 100km south of our flagship Bougouni Lithium Project 100km.

Fatou is reasonably well advanced and already has a preliminary 43-101 Mineral Resource Estimate developed by the previous owner Rockridge Capital. Fatou is regarded as highly prospective and is drill ready with the potential to expand defined zones of gold mineralisation. AngloGold Ashanti and Rockridge Capital explored Fatou from 2010 to 2014, developing an Inferred MRE exceeding 350,000 oz of gold for Fatou’s main prospect.

Geological Setting

The Fatou Project is hosted within the Birimian sequence of West Africa, a sequence of mafic volcanic rocks separated by sedimentary basins and are intruded by granitic rocks of varying composition. The geology at Fatou is mostly sedimentary sequences interlayered phyllite and siltstone along with abundant volcaniclastic and tuffaceous strata. These rocks are intruded by three phases of granodiorite occurring as small plutons and stocks. Minor mafic and felsic dikes occur as tabular stocks. The geology is weathered to a depth of 75m (typical depth between 35m and 50m) and laterite capped mesa are formed with the laterite extending for several metres’ depth.

The dominant structural feature observed at Fatou is a major northwest-trending shear zone which aligns the gold targets, local shear fabrics, folds, cross faults, low angle faults, planar fabrics, and crenulation. The northwest shears are inferred to be steeply dipping to slightly east-dipping and further low-angle structures have been interpreted in drill hole modelling that dip to the east.

Gold Mineralisation

Historic exploration identified gold mineralisation occurring as free gold in multi-stage quartz and quartz-carbonate ± sulphide veins. Sulphides associated with gold include pyrite, pyrrhotite, arsenopyrite, and possible bismuthinite. Gold-bearing veins are mostly subvertical in orientation striking N-S to north-westerly and appear to occur in clusters and local envelopes.

Gold in quartz and quartz-carbonate-sulphide veins are orogenic and typical of most gold occurrences throughout West Africa and in other greenstone terranes. These veins formed at upper mesothermal depths (5-10km) and are characterised by brittle to brittle-ductile fracturing of the host rock followed by infiltration of hydrothermal fluids that deposited quartz, carbonate, and metallic minerals including gold.

An initial Mineral Resource estimate was prepared in November 2014 for previous explorer Rockridge of over 350,000 ounces gold (0.6g/t cut-off) and was estimated for only the Fatou Main prospect and represent only part of the potential of the project.

Previous Exploration

Previous work on the Fatou concession includes regional soil sampling by United Nations Development Program in the early 1980s and further soil sampling by Orgagoe, a Malian company later in the 1980s. In the late 1990s to 2001, AngloGold undertook exploration that included soil sampling, aerial geophysics, RAB drilling, and RC drilling. Results indicated the presence of gold in surface and subsurface samples, but no follow-up work was completed due to changes in corporate exploration strategy.

Rockridge commenced exploration work in 2010 including extensive soil sampling, geophysical surveys, drilling, mapping, and initial metallurgical tests. This work culminated in the initial resource estimate.

Nangalasso Project, Mali

Kodal Minerals owns 100% of the 345km2 Nangalasso Project, which consists of the Nangalasso and Sotian concessions that Kodal owns exclusive access to and and option to purchase agreements.

The project is located in Southern Mali, approximately 250km from the capital of Bamako and 30km to the west of the world-class Syama Gold mine operated by Resolute Mining Limited (RSG:ASX) which has a current resource of 7.6Moz.

Previous exploration at Nangalasso has consisted of surface geochemical sampling, auger geochemical drilling, trench sampling and wide-spaced reconnaissance aircore drilling. A large geochemical gold anomaly has been defined at Nangalasso and results from the reconnaissance drilling include 3m at 7.1g/t gold within a broader zone of 21m at 1.25g/t gold, 3m at 7.84g/t gold, 1m at 7.8g/t gold and broad anomalous zones from trench samples including 7m at 3.84g/t gold.

The trench sampling programme undertaken in mid-2016 consisted of five separate trench locations for a total of 264m.Trenches were dug to a depth of 2m below surface, and samples were collected on a 3m composite basis. This sampling is considered a surface geochemical test and provided information regarding the depth of transported cover, information on the geological structure and alteration as well as confirmation of the surface gold anomalism.

The trench sampling programme consisted of:

| Trench Number | Length | Maximum Assay returned |

|---|---|---|

| NNTR005 | 60m | 0.27g/t gold |

| NNTR006 | 60m | 0.14g/t gold |

| NNTR007 | 60m | 0.10g/t gold |

| NNTR008 | 60m | 0.06g/t gold |

| NNTR009 | 24m | 0.37g/t gold |

This programme has confirmed the widespread surface gold anomalism at Nangalasso. The identification of the strong alteration, quartz veining and shearing highlight targets of geological interest and the results from the very wide-spaced and reconnaissance drilling completed to date indicates that the surface gold anomalism does reflects the sub-surface gold mineralisation.

Fatou Gold Project, Mali

The Slam Project is located in south-western Mali, approximately 100km from the capital Bamako in the “Siguiri Basin” sequence, which hosts extensive gold mineralisation including the Siguiri Mine (Anglogold Ashanti Limited), the Lefa Gold Mine (NordGold N.V) and the Tri-K Project (Avocet Mining plc).

Kodal Minerals acquired an interest in the SLAM Project in Mali as part of the acquisition of IG Bermuda in May 2016. The project consists of two nearby licence areas in south-west Mali, Djelibani Sud and Kambali and holds exclusive rights to exploration and development from concession owners, Gold Corp Mali SARL and Tourekounda SARL.

The former owner of the Slam Project announced results of an aircore drilling programme at the Kambali licence which highlighted the prospectivity of the Slam Project, with gold mineralisation returned from shallow depth, and the mineralised system remains open along strike. An extensive zone of artisanal workings is located within the Kambali exploration licence area, and reconnaissance drilling confirmed primary gold mineralisation beneath the shallow workings.

Results of the wide-spaced reconnaissance drilling included:

3m at 5.64g/t gold from 3m within a zone of 6m at 2.88g/t gold from 3m; and

6m at 1.12g/t gold from 30m to end of hole within a broad zone of 15m at 0.62g/t from 21m.

The next stage of work to be undertaken by the Group for the SLAM Project will require follow-up drilling at Kambali (subject to receiving an extension to the licence term) to attempt to define and extend the gold mineralised structure. It is anticipated that a second stage of reconnaissance aircore drilling will be completed prior to RC drilling.

No drilling has been completed on the Djelibani Sud exploration licence area. Review of the surface geochemistry has highlighted a strong surface anomaly that is associated with laterite material, and minor artisanal workings. This area requires infill geochemistry to define targets for drill testing.

Korhogo Project, COTE D’IVOIRE

Kodal’s Korhogo Project is a single concession asset in North Central Cote D’Ivoire.

Numerous phases of geochemical sampling has defined surface geochemical anomalies.

The recent sampling by the company has confirmed gold anomalous zones extending for over 2kms in strike and up to 600m in width. Further exploration is required to review these targets and prioritise further work.

Nielle Project, Côte d'lvoire

The Nielle project consists of one licence of 300km2 located in an underexplored region within the Tongon-Banfora greenstone belt that is host to the Tongon Gold Mine, recently sold by Barrick to Atlantic Group, and Endeavour Mining’s Wahgnion Gold Operations.

The Nielle concession has a gold anomalous trend extending for over 4.5km and remains open along strike. This significant trend has already confirmed high-grade gold mineralisation with RC drilling and this work is demonstrating the potential for additional high-grade primary gold mineralisation.

Kodal completed a reconnaissance aircore drilling campaign with a total of 152 drill holes for a total of 5,084m completed during the 2021 field season. The drilling was planned to target the strike extensions of the defined gold mineralised zone that has been confirmed by initial RC drilling as well as target new parallel targets that were indicated in surface geochemical anomalism including the recently discovered N’Golope target area.

Gold mineralised intersections are associated with strong alteration, sulphide mineralisation and quartz-carbonate veining. The results of the RC drilling programme confirm a gold mineralised system that remains open along strike and at depth. The presence of shallow gold mineralisation is reflected in the surface geochemical anomaly, and a review of the surface geochemical anomaly highlights additional targets for drill testing.

Aircore drilling was conducted in Q2 2021 and averaged 33m depth and intersected a weathered geological profile with the intersected gold anomalism associated with quartz veining and evidence of alteration. The bottom-of-hole gold anomalism further confirms that the surface gold geochemical anomalism relates to primary gold mineralisation and is a reliable exploration tool. Kodal’s review of the historic exploration has identified further targets requiring reconnaissance drilling and this completed wide-spaced aircore drilling requires infill definition to target initial RC drilling. Follow-up and extension drilling is planned to continue to test the defined gold mineralised zone as well as continue to fully evaluate the geochemical anomaly.

Nielle Exploration Programme

Reverse Circulation drilling totalling 27 drill holes for 3,117m completed.

Results include:

- 10m at 2.00g/t gold from 26m in drill hole NLRC0004;

- 8m at 4.26g/t gold from 8m in drill hole NLRC0006

Including 2m at 11.63g/t gold from 10m;

- 14m at 1.73g/t gold from 26m in drill hole NLRC0008;

- 26m at 1.95g/t gold from 32m in drill hole NLRC0012;

Including 4m at 5.51g/t gold from 42m; and

- 26m at 1.79g/t gold from 108m in drill hole NLRC0018;

Including 2m at 6.07g/t gold from 110m.

Gold mineralisation associated with shear zone and quartz veining with alteration in mafic volcanics and mineralisation in altered granitoid intrusion